An investment banking* committed to get you a step ahead

For almost 20 years, our team of professional experts in investment banking* have been supporting entrepreneurs, shareholders and top executives/ CEOs, in their development and transformation projects.

At each key decision-making stage, our professionals are there to provide strategic and independent advice, combined with a spirit of excellence, in order to anticipate, identify, design and implement their development processes, in a responsive and committed way.

We strive only for the success of our clients.

Key figures

deals a year (LBO, disposal, acquisition, capital increase, etc.) on the European mid-market segment

0

+

of operations completed successfully

0

%

Sectorial

expertise

0

Smart cities

Health Innovation

Digital

Green transition

Strategic Services and Industries

Lifestyle

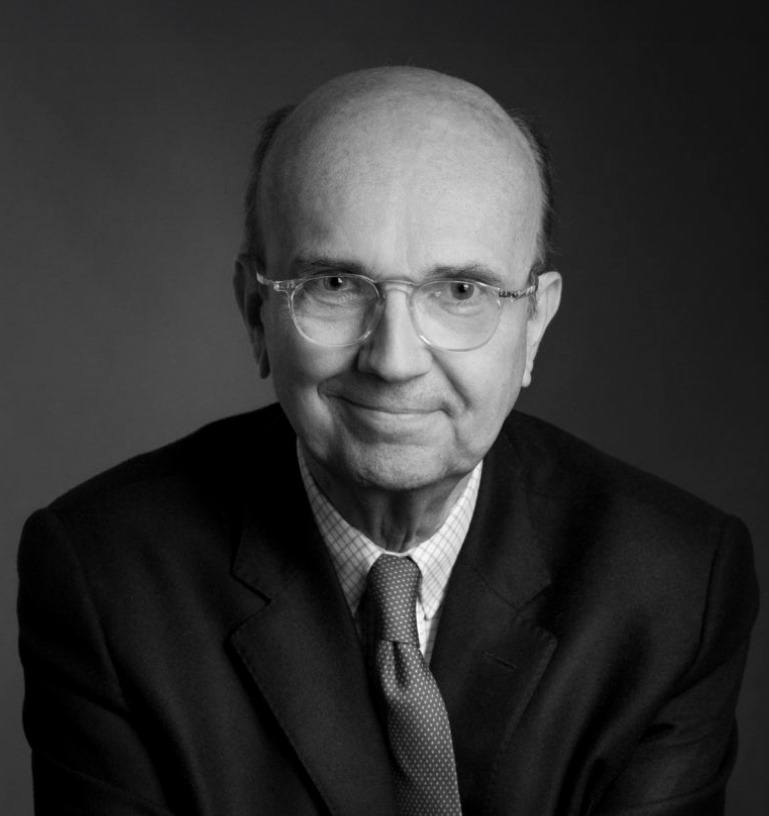

A team of 25 expert

and committed professionals

Strong experience and vision of high-potential sectors